Since when is Personal Finance a thing? When the world got super complicated, apparently. No longer is it just a decision of whether to put your money under the mattress, in a cookie jar, or in a bank to save for a rainy day. Now there are a bunch of acronyms, books, coaches, professional advisors, companies, blogs, and the list goes on. Having created so many moving parts, there is now a whole industry of Personal Finance. Where to begin?

Since when is Personal Finance a thing? When the world got super complicated, apparently. No longer is it just a decision of whether to put your money under the mattress, in a cookie jar, or in a bank to save for a rainy day. Now there are a bunch of acronyms, books, coaches, professional advisors, companies, blogs, and the list goes on. Having created so many moving parts, there is now a whole industry of Personal Finance. Where to begin?

PERSONAL FINANCE DEFINITION

First, let’s define Personal Finance so we can figure out who needs to know about it. According to the Cambridge Dictionary, Personal Finance is the activity of managing your own money. That would not seem to include the financial advisors who are professional money managers. Perhaps we need a more comprehensive definition. “Investopedia was founded in 1999 with the mission of simplifying financial decisions and information to give readers the confidence to manage every aspect of their financial life,” according to their website. Their simplified information includes this definition:

“Personal finance is a term that covers managing your money as well as saving and investing. It encompasses budgeting, banking, insurance, mortgages, investments, retirement planning, and tax and estate planning. The term often refers to the entire industry that provides financial services to individuals and households and advises them about financial and investment opportunities.

“Personal finance is about meeting personal financial goals, whether it’s having enough for short-term financial needs, planning for retirement, or saving for your child’s college education. It all depends on your income, expenses, living requirements, and individual goals and desires—and coming up with a plan to fulfill those needs within your financial constraints. To make the most of your income and savings, it’s important to become financially literate, so you can distinguish between good and bad advice and make smart decisions.”

OEKOLOGY

According to Wikipedia, the precursor of Personal Finance was Home Economics. More than cooking macaroni and cheese,

“Home economics, or family and consumer sciences, is a subject concerning human development, personal and family finance, housing and interior design, food science and preparation, nutrition and wellness, textiles and apparel, and consumer issues.

“Home economics courses are offered around the world and across multiple educational levels. Historically, the purpose of these courses was to professionalize housework, to provide intellectual fulfillment for women, and to emphasize the value of “women’s work” in society and to prepare them for the traditional roles of sexes.”

For more reading on the origins of Home Economics, see the Wikipedia article cited above and the History section of their article on Personal Finance and Barbara Richardson’s article entitled “ELLEN SWALLOW RICHARDS: ADVOCATE FOR “OEKOLOGY”, EUTHENICS AND WOMEN’S LEADERSHIP IN USING SCIENCE TO CONTROL THE ENVIRONMENT” Michigan Sociological Review 14 (2000): 94–114.

EDUCATION NEEDED IN SCHOOLS

The teaching of Home Economics has declined in recent years, according to a 2020 article, “Why is home economics not taught in schools anymore?: STEM, under-enrollment and competitive college environments are major culprits for the downfall of home economics” by Cortney Moore. On the other hand, according to most sources, the need for teaching on Personal Finance in schools is at an all-time high and most people think that teaching Personal Finance courses in public schools is a good idea. Unfortunately, mandatory finance courses are not ubiquitous yet.

FINANCIAL LITERACY IS FOR EVERYONE

In his “Personal Finance” article for Investopedia, Will Kenton writes about the importance of financial literacy and the need for self-education:

- “Few schools have courses in how to manage your money, so it is important to learn the basics through free online articles, courses, blogs, podcasts, or at the library. . . .

- “… You can learn everything you need to know for free online and in library books….”

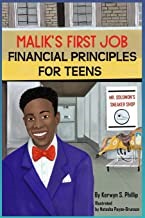

Although there are tons of information available to adults, books for teens are beginning to be published, too. One such book is Malik’s First Job: Financial Principles for Teens written by local author Kerwyn S. Philip and illustrated by local librarian Natasha Payne-Brunson. Kerwyn Philip teaches leadership, entrepreneurship, and financial literacy to youth in under-served communities. He has an MBA so he knows what he’s telling kids—his own included—is both accurate and helpful. Kerwyn Philip is also a former GET LIT / Black MaleEmergent Readers (BMER) committee member and a popular Get Lit/ BMER Black History Month presenter.

Although there are tons of information available to adults, books for teens are beginning to be published, too. One such book is Malik’s First Job: Financial Principles for Teens written by local author Kerwyn S. Philip and illustrated by local librarian Natasha Payne-Brunson. Kerwyn Philip teaches leadership, entrepreneurship, and financial literacy to youth in under-served communities. He has an MBA so he knows what he’s telling kids—his own included—is both accurate and helpful. Kerwyn Philip is also a former GET LIT / Black MaleEmergent Readers (BMER) committee member and a popular Get Lit/ BMER Black History Month presenter.

Join us for a virtual GET LIT Lunch & Learn about New Children’s Books by Local Authors featuring Kerwyn S. Philip who will talk about financial literacy and his new book Malik’s First Job: Financial Principles for Teens on Monday, March 21st at 12:00 Noon. Register here.